Tax Form For 401 K . Contributing to a traditional 401 (k) could. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you.

from www.usepigeon.io

Penalties for errors in tax returns;this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them.

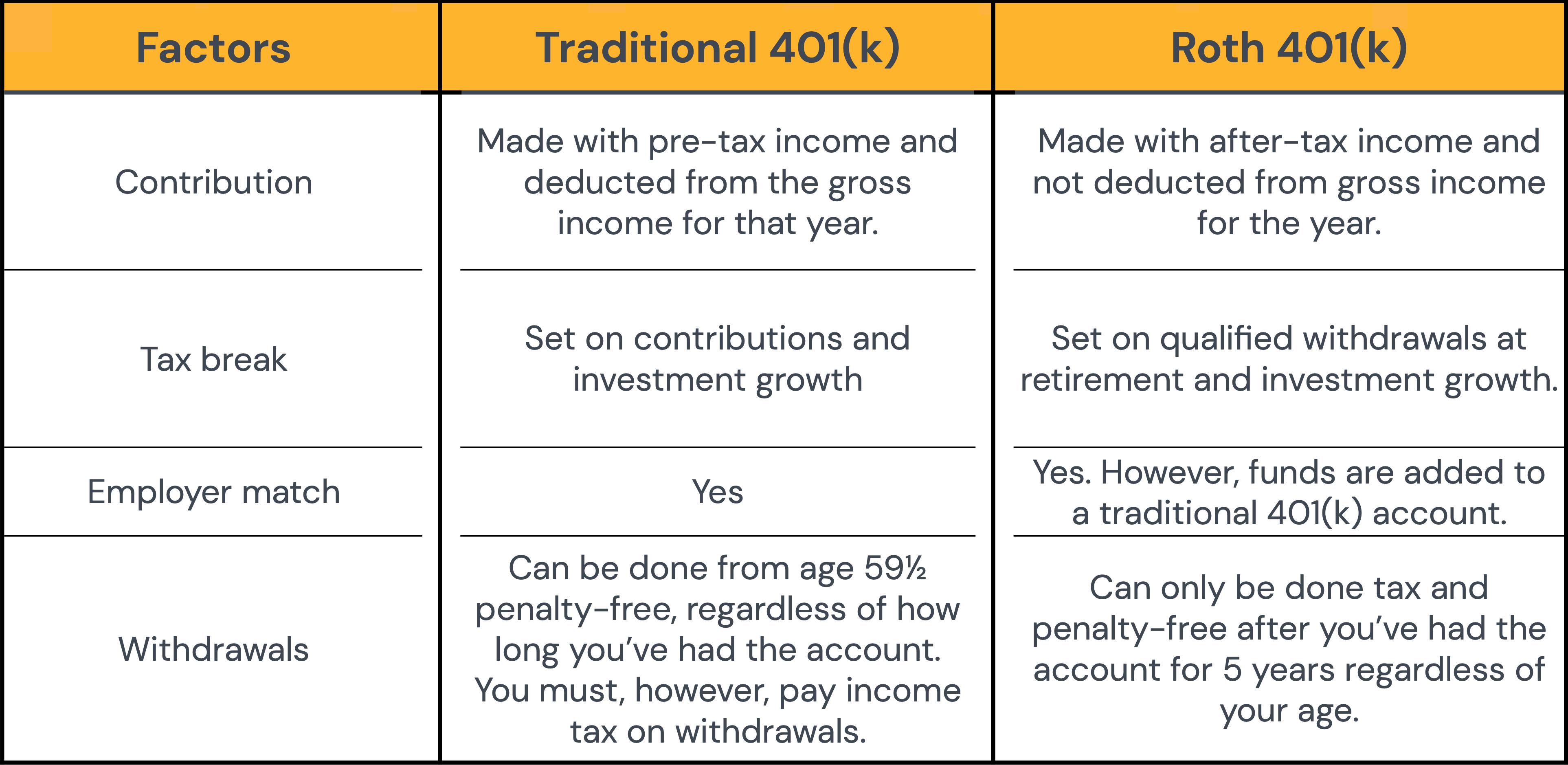

The Differences Between a Roth 401(k) and a Traditional 401(k)

Tax Form For 401 K unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. How does a 401 (k) withdrawal. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them.

From www.signnow.com

401 K Enrollment Form Complete with ease airSlate SignNow Tax Form For 401 K In general, roth 401 (k). unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. 401 (k) taxes on withdrawals and contributions. Contributing to a traditional 401 (k) could. How does a 401 (k) withdrawal. Tax Form For 401 K.

From www.uslegalforms.com

BB&T Corporation 401(k) Saving Plan Hardship Withdrawal Form 20122022 Tax Form For 401 K 401 (k) taxes on withdrawals and contributions. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. Penalties for errors in tax returns;this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more.to report the tax on early distributions, you may have. Tax Form For 401 K.

From www.uslegalforms.com

Ernst Concrete 401k Form 20202022 Fill and Sign Printable Template Tax Form For 401 K unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. traditional 401 (k) withdrawals are taxed at the account owner's current income tax rate. Contributing to a traditional 401 (k) could. How does a 401 (k) withdrawal. Penalties for errors in tax returns; Tax Form For 401 K.

From www.scribd.com

ADP20190212.pdf Irs Tax Forms 401(K) Tax Form For 401 K In general, roth 401 (k).this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. Penalties for errors in tax returns; Contributing to a traditional 401 (k) could. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. Tax Form For 401 K.

From psu.pb.unizin.org

Using 401(k) Retirement Money for Seed Funding Entrepreneurship Law Tax Form For 401 K Penalties for errors in tax returns; unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. 401 (k) taxes on withdrawals and contributions.this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. In general, roth 401 (k). Tax Form For 401 K.

From www.uslegalforms.com

Wells Fargo & Company 401(k) Plan Loan Payment Form Fill and Sign Tax Form For 401 Kto report the tax on early distributions, you may have to file form 5329, additional taxes on qualified plans (including iras) and. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them.this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. In. Tax Form For 401 K.

From www.aiohotzgirl.com

401k Rollover Tax Form Universal Network Free Download Nude Photo Gallery Tax Form For 401 K Penalties for errors in tax returns;to report the tax on early distributions, you may have to file form 5329, additional taxes on qualified plans (including iras) and. How does a 401 (k) withdrawal. traditional 401 (k) withdrawals are taxed at the account owner's current income tax rate.this tax form for 401 (k) distribution is sent. Tax Form For 401 K.

From www.formsbank.com

401(K) Change Request Form printable pdf download Tax Form For 401 K In general, roth 401 (k). Contributing to a traditional 401 (k) could. 401 (k) taxes on withdrawals and contributions. traditional 401 (k) withdrawals are taxed at the account owner's current income tax rate.this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. Tax Form For 401 K.

From www.usepigeon.io

The Differences Between a Roth 401(k) and a Traditional 401(k) Tax Form For 401 K In general, roth 401 (k). 401 (k) taxes on withdrawals and contributions.this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. How does a 401 (k) withdrawal. Tax Form For 401 K.

From www.slideserve.com

PPT Understanding the New Roth 401(k) PowerPoint Presentation ID510897 Tax Form For 401 K In general, roth 401 (k). How does a 401 (k) withdrawal.this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. unless you're a business owner, you won't claim your 401 (k) contributions. Tax Form For 401 K.

From library.myguide.org

Lets's understand W2 Boxes and W2 tax Codes A Guide by MyGuide Tax Form For 401 K unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. Contributing to a traditional 401 (k) could.to report the tax on early distributions, you may have to file form 5329, additional taxes on. Tax Form For 401 K.

From whoamuu.blogspot.com

401k Enrollment Form Template HQ Printable Documents Tax Form For 401 K Contributing to a traditional 401 (k) could. How does a 401 (k) withdrawal. In general, roth 401 (k). unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. Penalties for errors in tax returns; Tax Form For 401 K.

From www.annuity.org

401(k) Plans What Is a 401(k) And How Does It Work? Tax Form For 401 K Contributing to a traditional 401 (k) could. In general, roth 401 (k). unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. How does a 401 (k) withdrawal. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. Tax Form For 401 K.

From www.scribd.com

Stubs PDF Irs Tax Forms 401(K) Tax Form For 401 K unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you.to report the tax on early distributions, you may have to file form 5329, additional taxes on qualified plans (including iras) and. Contributing to a traditional 401 (k) could.this tax form for 401 (k) distribution is sent when you’ve. Tax Form For 401 K.

From www.hotixsexy.com

401k Withdrawal Form For Taxes Universal Network Free Nude Porn Photos Tax Form For 401 Kto report the tax on early distributions, you may have to file form 5329, additional taxes on qualified plans (including iras) and. 401 (k) taxes on withdrawals and contributions. Penalties for errors in tax returns; traditional 401 (k) withdrawals are taxed at the account owner's current income tax rate. In general, roth 401 (k). Tax Form For 401 K.

From www.formsbank.com

401(K) Deferral Election Form printable pdf download Tax Form For 401 Kthis tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. traditional 401 (k) withdrawals are taxed at the account owner's current income tax rate. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. How does a 401 (k) withdrawal. In general, roth. Tax Form For 401 K.

From www.formsbank.com

16 401k Form Templates free to download in PDF Tax Form For 401 K How does a 401 (k) withdrawal. In general, roth 401 (k).this tax form for 401 (k) distribution is sent when you’ve made a distribution of $10 or more. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you. 401 (k) taxes on withdrawals and contributions. Tax Form For 401 K.

From becomethesolution.com

How To 401k Hardship Withdrawal Step by Step Tax Form For 401 Kto report the tax on early distributions, you may have to file form 5329, additional taxes on qualified plans (including iras) and. In general, roth 401 (k). learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. unless you're a business owner, you won't claim your 401 (k) contributions as tax. Tax Form For 401 K.